Why do some big mergers succeed while others fail? This seems to be a common question, and some of the research I’ve read about the Dell-EMC merger tries to connect it to the HP-Compaq merger, which apparently cost Carly Fiorina her job.

I covered the HP-Compaq merger at length, and I was not a fan. I actually spoke to Compaq’s CEO and argued he should pull out to save his firm. There are some interesting backstories here that I think will provide color for the Dell-EMC merger.

I’ll close with my product of the week: the Surface Pro 4 — my current favorite 2-in-1 since Microsoft fixed every problem I had with the Surface 3.

HP-Compaq: Why It Was a Disaster

I’ll start off by saying that as big mergers go, the HP-Compaq thing really wasn’t that bad. Prior large-scale mergers that I covered — like IBM-ROLM and AT&T-NCR — had to be reversed. The latter contributed to AT&T’s collapse at the time.

I was an outspoken critic of the HP-Compaq merger, but not because it didn’t make sense. A good chunk of the HP board opposed it, and a major portion of that chunk consisted of the founding families. Given how difficult it would be to pull off a merger like that, I felt that it was impossible to execute it if powerful members of the board would be looking to kill it or cause it to fail.

The irony was that when I did the post mortem, I found out some interesting things. One was that nobody had done an initial merger plan. That alone would have meant disaster, regardless of the board’s position. However, the proxy fight that resulted between Carly Fiorina and Walter Hewlett forced her to commission one of the best merger plans ever seen at the time.

Another interesting tidbit was that none of the big investors in HP trusted Carly as far as they could throw a tank (which isn’t far). So when Carly came in to sell the deal to win the proxy fight they pretty much didn’t believe a thing she said. Then they’d meet with Walter Hewlett and conclude he wasn’t really any more credible than Carly was.

Finally, they’d meet with Michael Capellas, who had been a high-level management consultant before taking the CEO Job at Compaq, and he sold the deal. The reason I knew this is I had these big investors as clients, and I typically followed those traveling executives because the investors wanted our opinion of the deal.

Carly later forced Capellas out of the company, and she was fired largely because she sucked at what he did but she refused to let someone like Capellas work for her. My guess was she was afraid the board would give that person her job. (One interesting thing was that Carly was very similar to Steve Jobs in many key ways — one of which was she sucked at ops. So, much like Steve desperately needed Tim Cook, she needed someone like Capellas.)

So, the board conflict actually ensured the merger rather than killing it, and Carly’s effort to protect her job by getting rid of Capellas contributed heavily to her getting fired.

Granted, as with all mergers of this type — I call them “Frankenstein mergers,” because the process is like mixing and matching body parts — a lot of value was lost. Still, it didn’t kill HP, and HP did take over market leadership in a couple of key areas as a result.

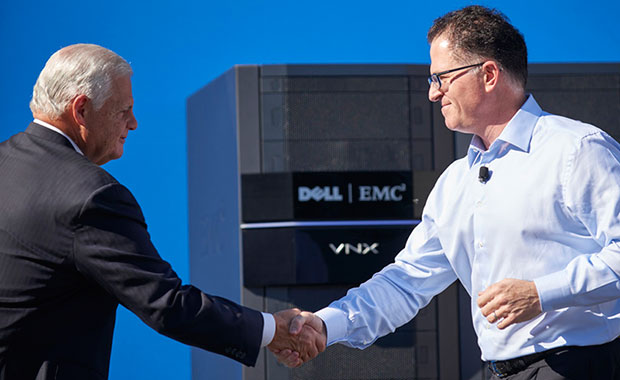

Dell-EMC: Why It Will Work

Dell-EMC is a very different beast. First, Dell is still run by its founder, so there are no founding families arguing against the deal, and Dell’s board appears to be behind it. In addition, Dell is a private company, so the speed with which it can execute is far faster. Because there isn’t any board disagreement in Dell, there will be no proxy fight.

In addition, Dell has the best acquisition-and-merger process in the industry. Rather than carving up the acquired company and then surgically attaching the best parts to Dell, Dell keeps the company separate as a standalone entity and simply looks for common synergies — like supply chain, which will benefit EMC — and it both identifies the key assets, including staff, and protects them rather than shutting them down.

So, unlike Compaq under HP, which fully disappeared, EMC will continue as a relatively independent company that Dell eventually will run. Joe Tucci, whom Dell is replacing, has wanted to retire for some time. Also, EMC is already an umbrella company with federated components, so Dell’s takeover should have little impact on day-to-day externally facing operations. Internally it will impact — but improve — things like supply chain, because Dell arguably has one of the best in the world.

At the end of this thing, Dell should have market leadership in something like 22 Gartner Magic Quadrants, which I don’t think any company ever has accomplished.

Wrapping Up: Contrasts

Carly Fiorina came up with the Compaq merger to shake up the company and get a fast path to targeted market leadership, but the process she used was massively flawed, and it resulted in equally massive internal conflict at the board level. Also, her own concerns about her tenure significantly contributed to her firing.

In contrast, Michael Dell uses the best merger process in the market and has no concerns about his tenure. Further, EMC is well structured for a relatively easy merger under Dell’s process, which leads the market. Given that virtually every merger Dell has undertaken since it implemented its current process has resulted in the acquired asset gaining in value, the odds favor a positive outcome.

The folks at EMC likely are breathing a sigh of relief, because Meg Whitman, HP’s current CEO, tried to buy the company first (or tried to get EMC to buy HP — it really isn’t clear) but couldn’t put a package together.

HP’s recent history of mergers generally has been catastrophic, with the relatively recent complete destruction of Palm by HP’s acquisition process a lasting example of how bad its version of the Frankenstein merger process actually is. Given the Palm outcome, and in keeping with the Halloween theme, we likely should call Whitman’s merger process the Dracula version, because it sucks the life out of the acquired company.

It continues to amaze me that there is a whole series of common disastrous processes that CEOs use — ranging from forced stacked ranking, which turn employees against each other, to Frankenstein (or Dracula) mergers — when there are far smarter alternatives. It just goes to show that there likely are a lot of CEOs at the moment who really, really don’t have the right skillset to be CEOs. However, in all fairness to Whitman, HP’s board is the bigger problem, as she is the company’s fourth CEO failure.

I’ve been carrying the new Surface Pro 4 for about a month, and it is pretty brilliant. I carried the old Surface Pro 3 for a number of weeks, but the relatively crappy keyboard eventually forced me to move to something else. The Surface Pro 4 keyboard is far more solid, and the keys far more comfortable. However, the really big change is the huge and very nice glass trackpad, which eliminates many of the really annoying problems with the older, smaller solution.

The product is light (well under 2 pounds), attractive, and has decent battery life. When it’s all I carry in my laptop bag, the bag feels almost empty. It is one of the first Intel SkyLake products, which means faster boot times as well as both longer battery life and better performance. The stylus also is improved, so it feels more like a pen. In addition to providing higher resolution and deeper colors, the Pixel Sense display makes it far more responsive to pen input.

This is the first of the new SkyLake 2-in-1s I’ve had to try, and it is impressive. Let’s see how it holds up against the offerings that will be coming in over the next two weeks. For right now, it is my favorite and my product of the week.

As a side comment, I just came back from Dell World, and four years ago I noticed a lot of folks were using iPads instead of notebooks. Two years ago, most of those folks were using Macs. This year, almost all were back to PCs — except there were about as many Surface Pro 3s and 4s as there had been iPads 4 years ago, and a passenger sitting next to me on the flight out had a new Surface. Could be a trend.

Hi,

Nice article – still good to get details of such big moves.

However, I’m really disappointed by the end of the article.

HP did 129 acquisitions and you only highlighted the PALM one(which I still regret so much but in that context it’s a pure buzzword) and you don’t evoke the EDS, Aruba, 3COM, Scitex, Peregrine, Mercury … and most of all lefthand & 3PAR acquisitions that definitely can be compare to the EMC merger in term of portfolio integration & challenges…

So for sure they won’t follow HP "Compaq – 2002" tracks to merge with EMC but i’m definitely awaiting how they can beat HP in portfolio harmonization through acquisitions.

HP uses the more common method of ramming firms together and they are still gutting EDS, they eliminated most of the folks at 3Par who persevered that firm’s culture, the top networking folks I knew have mostly left, same with security. The problem is the method. Which was why IBM created the method Dell uses, we realized it just didn’t work.

Hi,

I definitely agree that not everything rolled well but do you truly believe that you can keep several different firm cultures into one (especially with the strong HP culture)… If you can look to the bright side EDS propulsed HP in the outsourcing services world, 3Par made them leader in the storage business, 3COM gave them a reason to still compete agaisnt cisco and peregrine & Mercury pushed them at the 5th rank of software editor (which is completely crazy for a pure HW company). I’m still awaiting on how Dell will deal with this huge merge – Hope they will take the good from HP past acquisition and not the bad.