Technology research firm IDC released a report Tuesday in which it revised an earlier forecast on customer spending in the x86 server market for the remainder of the decade. The company downgraded its original projection that x86 shipments would increase 61 percent by 2010, now predicting an increase of just 39 percent.

The amended prediction is due to the “rapid emergence of multicore architectures and virtualization technologies” that have significantly restricted global x86 server shipments as customers purchase fewer but more powerful systems, IDC analysts said.

“The server market is at a crossroads and customer buying behavior is increasingly driven by the strategic business benefit of the IT investment rather than a singular focus on cost containment,” said Matt Eastwood, program vice president for IDC’s Enterprise Platforms Group.

“In today’s business environment, it is clear that technologies such as virtualization and multicore are particularly important enablers for the consolidated IT infrastructure IT organizations are increasingly seeking to deploy,” he added.

Disruptive Influence

Virtualization and multicore chips will reduce shipments of Intel- and AMD-powered x86 servers by 4.5 million between 2006 and 2010, according to the IDC report. That will cost the industry some US$2.4 billion in customer spending during that same time period.

Virtualization and multicore processors, the culprits driving customers’ move away from x86 servers, represent a significant reduction in operational costs for most businesses. Using virtualization, organizations can simultaneously run multiple operating systems on a single machine, while multicore processors can take on the workload of several single core chips.

“Each of these technologies is impactful to the market in their own right,” said Michelle Bailey, research vice president for IDC’s Enterprise Platforms and Datacenter Trends. “Unlike other previous multicore introductions that took time to become mainstream as customers changed their application code, virtualization allows customers to fully exploit the improvements in x86 processors immediately, accelerating business benefits and thereby increasing adoption rates.”

Businesses benefit because they buy fewer servers that have greater computing capacity and are able to consolidate their business functions.

“Customers are looking to utilize multicore processors and virtualization solutions more often,” Eric Krueger, worldwide PR manager for Industry Standard Servers at Hewlett-Packard (HP), told TechNewsWorld. “These more robust systems increase AUPs but allow customers to make more efficient use of their server investments.”

Muscle Machine

Far from lamenting the turn toward new technologies, representatives for both IBM and HP told TechNewsWorld that their respective companies are fully prepared for the challenges facing the x86 server market.

While HP has seen the x86 server market shift indicated in the IDC report, the company has seen increases in the average unit price of its x86 servers over the last year, especially as electrical power constraints become an increasingly important factor in an organization’s purchasing equation, according to Krueger.

“Despite this trend, however, we are finding that this is not having an impact on our volumes,” he stated. “HP continues to be No. 1 in x86 server market shipments quarter after quarter.”

The Bright Side

Far from displeased with the downgraded forecast, IBM execs are looking at the move toward virtualization and enhanced computing power as a boon.

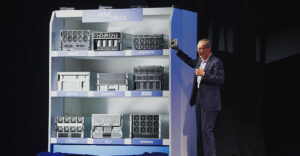

“Virtualization and the evolution of the hardware — multicore architectures, larger memory capacity, etc. — are very beneficial for IBM because that’s the type of system we’ve been deploying to the industry even outside x86, i.e. our mainframes and midframes. So, I see all of that as very positive,” Rob Sauerwalt, global brand manager for System X at IBM, told TechNewsWorld.

The shift allows IBM to draw upon its long history of building powerful machines to meet an enterprise’s computing needs, he noted.

“If you look at all of these trends, the most important thing for me as an IBMer is, where are we positioned in the market place because of these trends? The industry is moving in a direction that really has a bias toward IBM based on our past experience,” Sauerwalt stated.

“It’s one of those wonderful scenarios where I can leverage what we’ve already done, even as far back as 40 years ago when we introduced the mainframe, and I can make that relevant, pertinent and valuable to customers right now 40 years later. I love it when that happens. So, for me this is all positive,” he concluded.