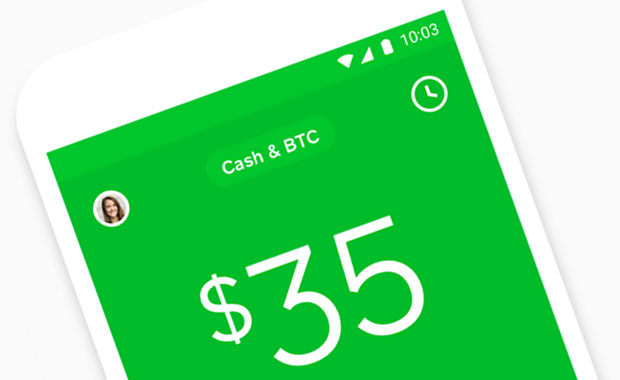

Square on Monday announced that Cash App users could buy and sell bitcoin in all 50 U.S. states.

Red, white, and bitcoin. Now you can use Cash App to buy bitcoin in all 50 states. pic.twitter.com/D4fhVRz7WL

— Cash App (@CashApp) August 13, 2018

Square’s share prices jumped Tuesday to an all-time high of US$75.15 on the news that Cash App downloads had exceeded those of PayPal’s rival Venmo service. Total Cash App downloads stood at 33.5 million compared to Venmo’s 32.9 million.

Cash App this year will contribute $30-40 million, or about 2-3 percent of Square’s adjusted net revenue, according to Nomura analyst Dan Doley.

Cash App’s History With Bitcoin

Square began testing Cash App’s bitcoin purchasing option last fall and officially launched the option early this year.

However, it was not available in four states — New York, Georgia, Hawaii and Wyoming — because of their more restrictive regulation of bitcoin transactions.

Square later extended the option to Wyoming after it removed a requirement that companies dealing with virtual currencies must maintain cash reserves equal to any cryptocurrency funds held for their customers.

Square then became the sixth firm to be awarded a virtual currency license, better known as a “BitLicense,” by the NYC Department of Financial Services.

Cryptocurrencies Flailing

Cryptocurrencies recently have been taking a beating.

Bitcoin’s price fell below $6,000, considered a critical mark, before recovering Tuesday morning. That is a far cry from last year’s high water mark of nearly $20,000.

“Bitcoins have no intrinsic value,” noted Michael Jude, program manager at Stratecast/Frost & Sullivan.

“Anything that is backed by nothing tangible has a floor value of zero. So, making it easier to buy in just makes it easier to lose in the long run,” he told the E-Commerce Times.

“The bubble for bitcoin is over,” remarked Edgar Radjabli, managing partner at Apis Capital Management.

Bitcoin “may end up starting another bull run or keep going down,” he told the E-Commerce Times, but it currently “does not look like it’s going away. There’s still over $200 billion in crypto market cap out there.”

Bitcoin “may certainly fall further but the cryptocurrency market does not appear to be collapsing,” Radjabli added.

Seen in that light, Square’s announce makes sense, he said.

Square’s Bitcoin Rationale

Square CEO Jack Dorsey has expressed the view that the Internet eventually will have a single currency, and that it will be bitcoin.

“I do believe that cryptocurrencies will become the medium of exchange for the Internet because they’re so much easier,” Radjabli said. “Traditional banking has too many middlemen, too much friction, slow transfer times, and unnecessary overregulation.”

However, bitcoin will not be the cryptocurrency of choice, in his view.

Making Money on Bitcoin

Square generated more than $70 million in bitcoin-related activity in the first half of 2018 and earned less than $500,000 in trading fees, meaning its bitcoin-related expenses were very high.

That raises the question of whether it has been getting an acceptable ROI on its bitcoin activities.

Cryptocurrency is not a major monetization engine for the firm, Square CFO Sarah Friar reportedly has said. Rather, the goal is to continue to drive utility in the Cash App.

However, Dorsey seems to view the move into bitcoin as a learning experience.

Square “may be only counting their transaction fees here,” Radjabli suggested.

“They are likely also making the spread between the price they are charging the client and what they’re getting on the market,” he pointed out.

“I think [bitcoin] can be a monetization engine because Square can make more than 1 percent — their current average profit margin on merchant processing — on bitcoin transactions because of the spread,” Radjabli suggested.

Vegas Revisited

“Using bitcoin as a learning experience is interesting, but for every winner there are lots of users,” Frost’s Jude pointed out. “Bitcoin has turned into a way for high rollers to take money from inexperienced investors.”

So long as the current economic expansion lasts, cryptocurrencies will do well, he said. “Once people are pressed by an economic downturn, the cryptocurrency market will explode.”

Cryptocurrency “is the hot topic right now, and the get-rich-quick crowd has latched onto it,” Jude observed, “but most people don’t understand it, and many have lost money in the market.”

Regulators have been taking an interest in cryptocurrency, Jude noted, and “that’s not a good sign. Once they figure out this is just an unregulated gambling concern and not a true market, they will move to either regulate it or shut it down.”

Some countries “have basically regulated cryptocurrency out of existence,” he said. “Expect many others to follow suit.”

There is too much uncertainty around the cryptocurrency market, Radjabli said. “Regulators need to create a clear framework that serves to protect consumers but is efficient and not overly burdensome.”

Cryptocurrency has been gaining ground among merchants, but its acceptance has been limited because of volatility, Radjabli said.

Still, “the future of crypto is not speculative,” he maintained. “It’s technology that allows quick, inexpensive, efficient payments globally.”