Some 60% of consumers believe their self-monitoring home security systems keep them just as safe as monitoring provided by security pros, according to research released by Parks Associates.

“Consumers view self-monitoring as a way to be notified of what’s going on in their homes. For many of them, that can provide the peace-of-mind that’s safe enough for certain households,” Parks President and CEO Elizabeth Parks told TechNewsWorld.

Based on a survey of 8,000 U.S. internet households, the research also found that the major reason for canceling professional monitoring systems was cost, with 25% of consumers citing “fees too high” as their reason for terminating their monitoring services.

Also mentioned as reasons for cutting professional monitoring were an increased sense of neighborhood safety and a realization that the household doesn’t use its system enough.

While many consumers feel their self-monitoring systems keep them safe, professional monitoring services remain popular.

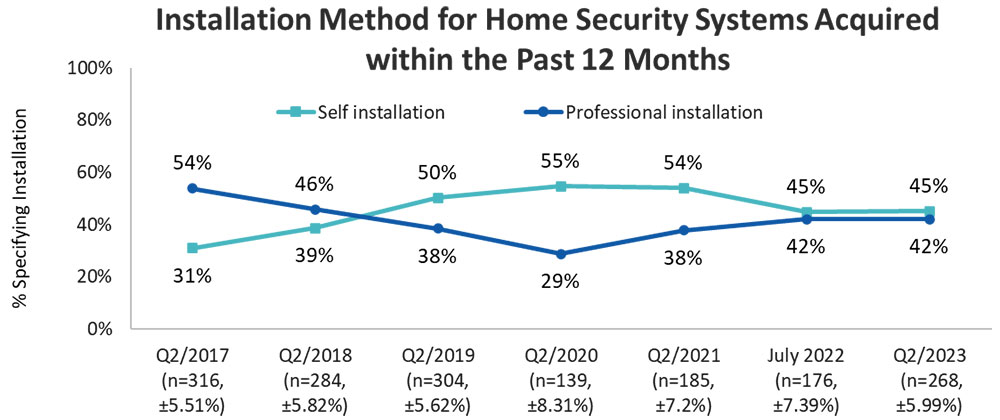

“During the pandemic, security dealers couldn’t get into people’s households,” Parks explained. “People didn’t want them in their households, either, so that’s when remote monitoring began picking up and systems began to be easier to install for installers and consumers.”

“Professional installation has gotten back towards pre-pandemic levels,” she continued, “but in the last 12 months, 42% of consumers say their security systems were professionally installed, while 45% say their systems were self-installed.”

Chart provided courtesy of Parks Associates

Pros Bounce Back

Mark N. Vena, president and principal analyst at SmartTech Research in San Jose, Calif., pointed to several reasons for the professional services bounce back following the pandemic.

“Initially, the pandemic likely spurred a surge in DIY installations due to lockdowns and increased time spent at home,” he told TechNewsWorld. “However, as life returns to normalcy, consumers may prioritize convenience and reliability, favoring professional installations for comprehensive coverage and expert assistance.”

Vena added that technological advancements and the affordability of professional services might attract homeowners seeking integrated solutions.

He asserted that concerns about installation complexity or reliability issues with DIY setups could also contribute to the shift.

Security companies also changed their market approach post-pandemic, noted Adam Wright, senior research analyst for the smart home at IDC, a global market research company.

“Professional installers have significantly diversified their offerings while also increasing their marketing and consumer outreach,” he told TechNewsWorld. “Most now have DIY a-la-carte solutions that compete well against the traditional DIY side of the market.”

You Get What You Pay For

For some consumers who can afford them, security monitoring services can offer benefits not found in DIY systems. “Self-monitoring is a cheaper option, but it falls short in many aspects, including not receiving or seeing alerts and not being able to call for help yourself,” Wright said.

“In almost all cases, professional monitoring is best across all metrics, except price,” added Anna Redmond, founder of Braav, a private security solutions provider, in Santa Monica, Calif.

“The exception is if the homeowner has a unique situation and is looking for something specific, such as tracking a nanny taking care of a child,” she told TechNewsWorld.

“Professional monitoring delivers reliability, accountability, and, from qualified companies, a best-practice-driven process for identifying and reporting issues,” she added.

While self-monitoring offers flexibility and cost savings and empowers users with direct control and real-time alerts, Vena observed that it lacks professional expertise, potentially leading to missed threats or false alarms.

“Professional monitoring assures trained personnel continuously monitor for emergencies, providing swift response and peace of mind,” he said. “Yet, it typically comes with higher costs and may involve longer response times due to intermediaries.”

Garnering Consumer Acceptance

Vena noted that security system providers can wear down resistance to their wares by emphasizing the value of their expertise, reliability, and comprehensive coverage.

Offering flexible pricing plans, personalized solutions, and excellent customer support can also address concerns, he added, as well as integration with smart home appliances.

“By demonstrating seamless compatibility and enhancing the overall home automation experience, professional providers can attract clients seeking a holistic approach to home security and automation,” he said.

Redmond agreed that professional installers should emphasize the value they can deliver, but they should couple that message with actual examples of clients they have helped.

“Home security is an emotional purchase, and people need to be able to imagine how home security will positively impact their lives and keep them safer,” she said. “Integration with smart home appliances can be a selling point, but ultimately, people buy because of an emotional need.”

Security providers can also garner consumer acceptance by offering popular devices.

“Marketing user-friendly devices like doorbells and networked cameras as a bundle should be a priority in every dealer’s portfolio,” Parks said. “This approach simplifies the buying process for consumers and enhances the appeal of these products by showcasing their combined security benefits. Consumers understand the value proposition for these devices.”

However, IDC’s Wright sees the challenge for security providers as simple. “I think it all comes down to pricing,” he maintained. “They need to compete more strongly on price to increase their value proposition.”

Competitive Dynamics

Parks’ research also addresses the competitive dynamics in the home security market. “ADT is the powerhouse player for professionally monitored security,” Parks said. “They’ve refocused on the residential and SMB market with the sale of their commercial business.”

“They’re competing more and more with single devices and DIY systems,” she continued. “Network cameras and doorbells are becoming directly competitive for the traditional security players.”

“Traditional players are offering robust services, and they’re transitioning their offerings from being a home security provider to a lifestyle home service provider,” she added. “It’s about comfort, control, convenience, and knowing what’s going on in your environment beyond security and safety at your door.”

Wright explained that two broad segments have defined the smart home market since its inception: do-it-yourself solutions and fully managed solutions.

DIY solutions are purchased by end-user consumers who install, configure, and manage these solutions on their own. Fully managed solutions are professionally installed by service providers and tend to be tied with other services, such as broadband or residential security.

“While these segments have competed along almost separate lines of differentiation for some time, in the past 12 to 24 months, the competitive landscape has shifted, whereby the point of demarcation between the two segments is rapidly blurring,” he said. “DIY solutions are now expanding their professional monitoring services, and the managed services vendors are expanding their DIY offerings in response.”