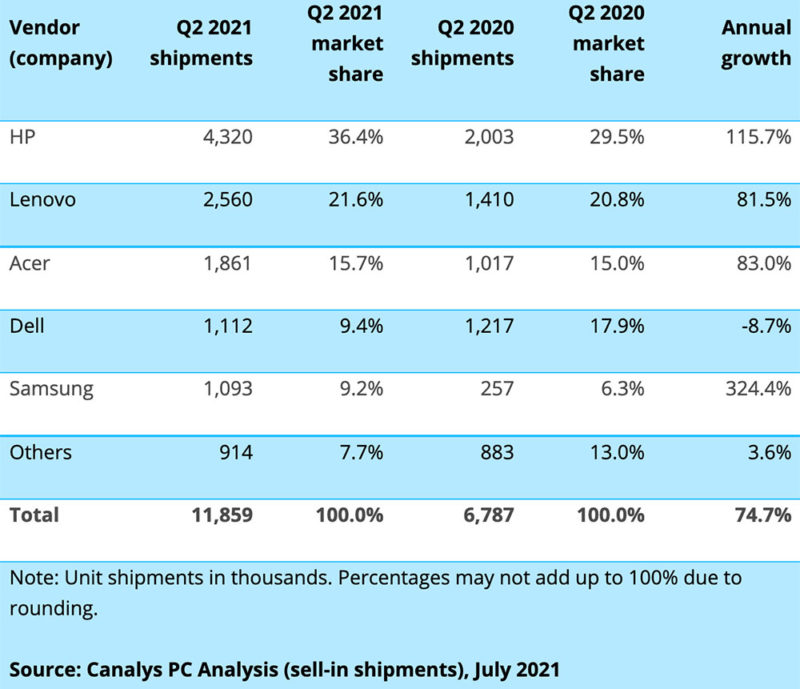

Chromebooks were a hot commodity in the second quarter of this year, with shipments increasing 75 percent compared to the same period in 2020.

Some 11.9 million of the laptops were shipped during the April-June quarter, or 13 percent of all notebooks, according to Canalys a global market research company.

“Chromebook vendors have doubled down on investments in the product category and most have continued to see strong returns in terms of growth,” Canalys noted in a report released Thursday.

HP led the pack in shipments with 4.3 million units, an increase of 116 percent over last year’s second quarter, followed by Lenovo (2.6 million units) and Acer (1.8 million units).

“The success of Chromebooks is proving to be remarkably resilient,” Canalys analyst Brian Lynch said in a statement.

“Their growth streak has extended well beyond the height of the pandemic as they have cemented a healthy position across all end-user segments in the industry,” he continued.

“Even as key markets like North America and Western Europe have seen schools begin to open up, shipments remain elevated as governments and education ecosystems plan for long-term integration of Chromebooks within digital learning processes,” he added.

Component Advantage

In an interview with TechNewsWorld, Lynch explained that Chromebooks also had an edge over other notebooks because they were able to better deal with component shortages created by the Covid-19 pandemic.

“It allowed them to eat up quite a bit of market share, as well as the boom in the education market, which Chrome dominates,” he said.

“Chromebooks use AMD processors more than Windows devices, and AMD was able to handle component shortages a little better than Intel,” he added.

Market research firm IDC also had strong year-over-year numbers for Chromebooks, pegging growth at 68.6 percent on shipments of 12.3 million units.

While this wasn’t a record quarter for Chromebooks, it wasn’t far off the prior two quarters, which shattered previous highs, IDC noted.

It warned, however, that while still in high demand and even on backlog for many education deals, vendors have started prioritizing higher margin Windows laptops given the ongoing component shortages.

“While there isn’t a single solution globally, many emerging markets continue to ramp up use of Android tablets while schools in some developed markets like the USA and Canada lean more toward Chromebooks,” IDC analyst Anuroopa Nataraj said in a statement.

“That said,” she continued, “there has also been a recent uprising of Chromebooks in areas of Europe, as well as a few Asian countries as schools start opening up to platform change.”

Attractive Value Proposition

Education is definitely a sweet spot for Chromebooks.

“Chromebook volumes continue to be propelled by the education marketplace and the funding currently put in place to support more broad availability of Chromebooks to students,” NPD Group Vice President Stephen Baker told TechNewsWorld.

“Education continues to be a big Chromebook market and with kids going back to classrooms, many schools are buying new Chromebooks because the ones that they have are pretty old,” added Jack E. Gold, founder and principal analyst with J.Gold Associates, an IT advisory company in Northborough, Mass.

The Chromebook’s value proposition also continues to attract buyers.

“With the uncertainty around back-to-work in many parts of the country and the world, Chromebooks provide a low-cost way to provide access to a keyboard equipped laptop for students or people with lightweight computing needs,” observed Ross Rubin, the principal analyst at Reticle Research, a consumer technology advisory firm in New York City.

Recently, however, some Chromebook makers have started aiming higher than the low end of the notebook market.

“We’re seeing high-end Chromebooks from HP and Lenovo that cost more, are made from better materials, are sleeker, and have more appeal to business users who don’t want something that looks like a toy, as a $200 Chromebook might,” Rubin told TechNewsWorld.

“One of the best things to happen to Chromebooks was recently announced by Microsoft,” he added. “That’s Windows 365, which allows a user to have a full PC in the cloud. If you can access a PC in the cloud, the client device becomes less relevant because you can have access to Windows software on a Chromebook.”

Breaking Out of Education

Gold told TechNewsWorld that more and more enterprises are taking Chromebooks more seriously.

“We know that because higher-priced Chromebooks are entering the market,” he reasoned.

“$199 isn’t the sweet spot anymore,” he continued. “It’s more like $350, $450. We’re even seeing $700 to $800 Chromebooks with features for the enterprise — manageability, more rugged construction.”

“As more organizations adopt a cloud-first strategy for work, they’re finding that they don’t need a heavy-duty PC to access it,” he added. “The cloud is making companies rethink the thin versus thick client issue.

Lynch noted that with Chrome’s hold over the education space relatively secure, Google is set to bet big on the commercial segment this year.

“We expect to see a strong focus on attracting small businesses with updated services, such as the new ‘Individual’ subscription tier for Google Workspace and promotions on CloudReady licenses to repurpose old PCs for deployment alongside existing Chromebook fleets,” he said in a statement.

Modest Tablet Growth

Canalys also reported a more modest growth of four percent for tablets during the period on shipments of 39.1 million units.

Apple was the leader in tablet shipments with 14.2 million units, followed by Samsung with 8.0 million, and Lenovo with 4.7 million.

Although Samsung and Lenovo trail Apple, their year-to-year shipments increased — 13.8 percent for Samsung, 77.5 percent for Lenovo — while Apple shipments declined slightly, by half a percent.

“A lot of tablet growth is in Asian markets, where there’s no bias toward Apple, as there is in the West,” Lynch told TechNewsWorld.

Rubin added that both Samsung and Lenovo have introduced some higher-end tablets that are more competitive with Apple’s iPad.

“Those products also implement the productivity layer in Android that allow it to act more like Windows,” he said.

Baker noted that in the U.S. NPD continues to see very strong growth for tablets as the pandemic has increased demand for additional large portable screens in the home.

“We see across all brands and OSes a growing emphasis on larger screens and better performance as the tablet market continues its push to becoming more PC-like in the more premium products,” he added.