Smartphone sales have been rising.The 968 million smartphones sold surpassed the sales offeature phones for the first time, Gartner noted earlier this month. However, sales actually topped 1 billion, according to IDC. What’s the difference of 32 million betweenfriends? Not much.

Here’s a more important point: High-end smartphone sales have been slowing fast, while low-endsmartphone sales have been rising fast, both companies observed.

This may lead to the assumption that in order forsmartphone manufacturers to do well, they need to sell sub-US$200 — andeven sub-$150 — “smartphones.” If they don’t, they’ll miss out onsomething really super important.

The problem is, when you look at smartphone revenues and profits, there appears to be no upside for Apple in chasing the low end.

Apple snagged 87.4 percent of mobile phoneearnings before interest and taxes in the fourth quarter of 2013, said Tavis McCourt, an analyst with Raymond James, in an Investors.com report.

Samsung claimed 32.2 percent of industry profits.

If you’re doing themath right now, don’t worry about hurting your head — McCourt’s mathtakes into account the industry total earnings that resulted from manymanufacturers actually losing money in the fourth quarter. Basically,while Apple and Samsung are raking in profit, their competitorshave been burning money just to stay warm.

Chump Change at the Low End

Because the volumes are so high in the low-end smartphone market –it grew to 42.6 percent of global volume to reach 430 million units in 2013, IDC reported — there’s a false sense of opportunity.

If McCourt’s revenue and profit math is anywhere close tobeing accurate, it shows that 430 million units of low-end smartphonesales have resulted in very little profit for anyone but possiblySamsung, which sells many different models of phones at both the highand low ends.

Even if low-end smartphone sales were to double in 2014, the amount of profit likely would be a trickle compared to what Apple collects now.

Still, Shouldn’t Apple Change Course?

I can’t wait for a cacophony of analyst, pundits and players to beginin earnest this year.

Apple will have to cope with the flood of lower-priced phones that will hit markets around the globe, Antonio Viana, president of commercial and global development at ARM Holdings, told CNET earlier this month.

They’ll be under pressure to do something, he maintained.

I’m not so sure. Heck, if I were running Apple, I’d keep the buspointed straight ahead and hit the gas. Here’s why:

- Despite sliding market share in terms of unit volume, Appleearned 87 percent of mobile phone industry profits — up from 77percent last year. That’s a massive leap forward despite losing something as “important” as unit market share.

- Apple earned far more profit than everyone else — includingSamsung — despite the competition releasing a flurry of seriouslygood smartphones. The competition has never been stronger.

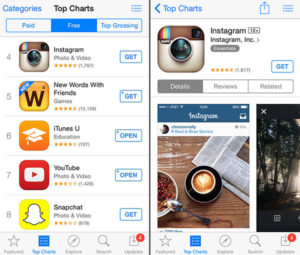

- Apple sells high-end devices at an enviable profit — and thenturns that sale into additional profit via its iTunes and App Storeecosystems. In 2013, iTunes revenue leaped to nearly $24 billion orso. Which other phone manufacturer has anything like this at all?Google? Nope. Google sold the money-bleeding Motorola unit to Lenovo.

- If the low end of the market represents such a Shangri-La, therevenue just doesn’t work out. In the fourth quarterof 2013, Samsung delivered 82 million units, while Apple delivered 51million. Apple’s effort claimed 87.4 percent of all revenue whileSamsung’s took in 32.2 percent, according to IDC. What does this tell us? It tells usthat the very best, most dominant Android competitor is making farless than half of Apple’s profits while producing 30 million more units to sell. Ouch. That’s pretty freaking amazing execution by Apple, never mind that every single competitor other thanSamsung claimed just a tiny blip of profit — or none at all. Those competitors includeMicrosoft, Nokia, LG and Motorola. Aren’t they supposed to bepowerhouse companies?

Let’s put it another way: In 2013, Samsung had to sell 300 millionsmartphones — double Apple’s 150 million — in order to capture farless than half of Apple’s revenue, based on Gartner’s figures. Even assuming the actual count is closer to the 314-to-153 million in unit sales IDC reported, the ratios are similar.

Meanwhile, it appears that Samsung has to work far harder than Appleto capture that revenue — particularly in advertising spend. Thereports are varied and difficult to pin down accurately, but Samsungconsistently appears to slightly outspend Apple in the U.S. and faroutspend the company abroad.

Which business would you rather be in? The one that hopes the futurenot only will remain consistent but also will pay off at some nebulous date? Orthe one that makes insane profit right now?

Putting the Low End Into Perspective

To follow this line of thinking applied to lack of profitseen by most manufacturers in 2013, it would be like telling your young daughter to sell cookies at a loss in the hope that she’d develop loyal customers she could potentially keep and upsell in a yearor two. I don’t know about you, but I think even the small children in AT&T’s thinktank could decide which would be better.

This one is pretty good, too: